The Reserve Bank of India (RBI) recently introduced a credit line on the Unified Payments Interface (UPI) platform to boost digital transactions in the country. This credit line aims to provide users with instant credit while making payments through UPI, offering greater flexibility and convenience. RBI’s credit line on UPI mandate has not only opened up the potential to expand India’s credit market, but also reimagine lending in India.

Despite, the unknowns or grey areas pertaining to guidelines on the execution of the Credit line on UPI, banks should be prepared and their technology systems running the Credit line on UPI is aligned to different possibilities and use cases.

One of the questions in the Poll we conducted during a recent webinar, among bankers and financial services executives, was – “Do you plan to you use the existing systems or implement something new to run credit line on UPI operations?”. A significant 65% indicated they will use the existing systems, and a sizeable audience – 35% – said that they will build up the new operations systems. It’s a mixed view on the approach banks will take to run their credit line on UPI operations.

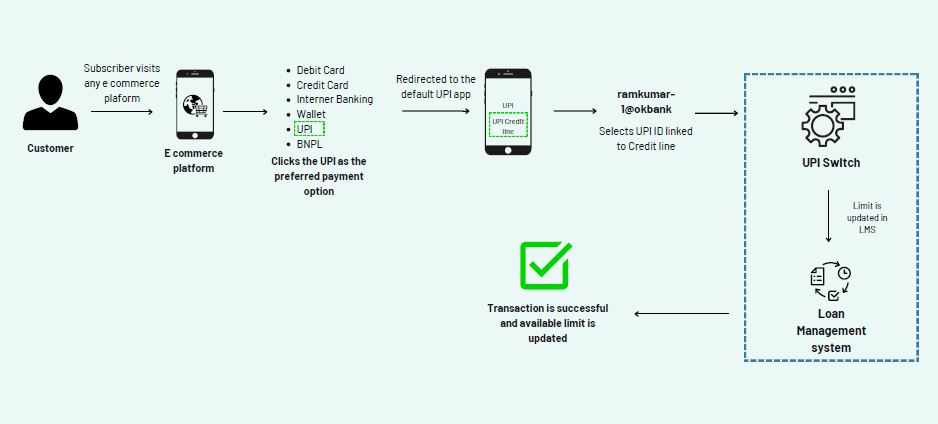

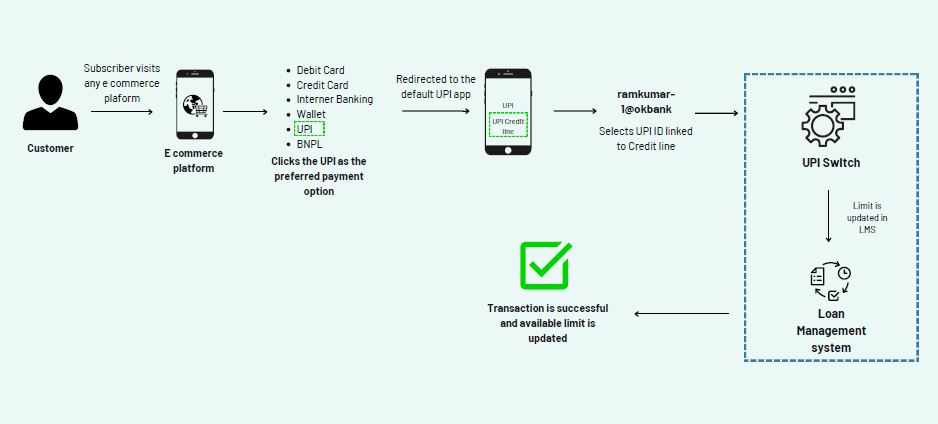

Credit Lines Through UPI: Potential User Journey

(Source: Pennant – The Digital Fifth Webinar)

For running efficient operations, the following technology considerations need to be kept in mind while planning for Credit line on UPI service:

- Highly composable and flexible credit system. The credit line on UPI will be targeted at the large retail and possibly SME space in the future, with diverse socio-economic, demography and other attributes. Along with the requirement of targeting credit-worthy audience, the credit line operation will also need to have high performance capability across flexibility, adaptability and scale. Hence, highly composable systems with robust and resilient system capabilities to effectively perform for high volume transactions will be a core need for the credit line on UPI product to succeed.

- Integration. The integration with the UPI platform is crucial to facilitate seamless credit line transactions. This may require upgrading payment infrastructure and implementing necessary APIs.

- Secure systems. The robust security measures should be in place to protect against fraud and unauthorised access. This may include implementing multi-factor authentication, encryption, and regular security audits.

- Performance at scale. Scalability and performance should be ensured to handle the increased volume of credit line transactions. This may involve upgrading systems, applications, servers, network infrastructure, and optimising software for high performance.

- Real-time capabilities. Real-time transaction processing capabilities are essential to provide instant credit decisions to customers. Banks may in all probability will start Existing-to-Bank (ETB) customers, where it will be easy to administer pre-sanctioned limits, however with the passage of time this product may be opened to the New-To-Bank (NTB) customers. In such instances, underwriting the customer real-time may be a key imperative. Hence, banks will need to invest in technology systems that can handle real-time processing and provide quick credit decisions based on predefined criteria.

- Robust Analytics. Data analytics and reporting capabilities should be leveraged to analyse customer behaviour, identify creditworthy customers, and make informed lending decisions. Implementation of data analytics tools and integrating them with existing systems should be an important consideration.

Banks should prioritise technology systems requirements and upgrades to tap into the credit line on UPI opportunity. Importantly, the need is for an overall tech landscape that seamlessly integrates with existing banking systems, such as core banking, loan management, and risk assessment systems, for efficient credit line management and streamlining the overall lending process.

By investing in the right technology systems and infrastructure, banks can provide a seamless and secure credit line experience to their customers while effectively managing credit risk.

Read the transcript of our recently conducted webinar on Credit Line on UPI

For more resources on Credit line on UPI, please click here.