The total SME lending is over $450 billion in Australia. According to the Australian Banking Association, 98% of Australian businesses are small or medium-sized enterprises. The SME sector plays a vital role in Australia’s economy, contributing significantly to employment and economic growth. Yet the challenges of the unique and evolving needs of SMEs have long challenged traditional lenders in Australia. It’s time the lending sector had a “SMELL” for the coffee by addressing ‘Small & Medium Enterprise Lending Lifecycles’.

It’s no surprise then, that a segment that accounts for approximately 35% of total business lending in Australia (Reserve Bank of Australia) has gradually opened itself up to innovation.

But is there more that can be done? A PwC report highlights that 54% of Australian SMEs believe that access to finance is a significant barrier to growth. In this blog, we dive into how banks can steer ahead of the competition to overcome SME lending challenges in Australia.

The COVID-19 pandemic has significantly impacted SME lending in Australia. SMEs have experienced significant loss in revenue due to COVID-19. In response, banks have had to adapt quickly to support SMEs, such as by providing loan repayment deferrals for up to 6 months, increasing overdraft limits and fast-tracking loan approvals. For instance, the Commonwealth Bank approved over $1.5 billion in loans to SMEs within 48 hours under its Rapid Business Loan scheme.

In the current landscape of SME lending in Australia, lenders have made significant strides in innovating and addressing challenges. But there is still potential for further advancements and opportunities to steer and accelerate SME Lending towards the trajectory of profits:

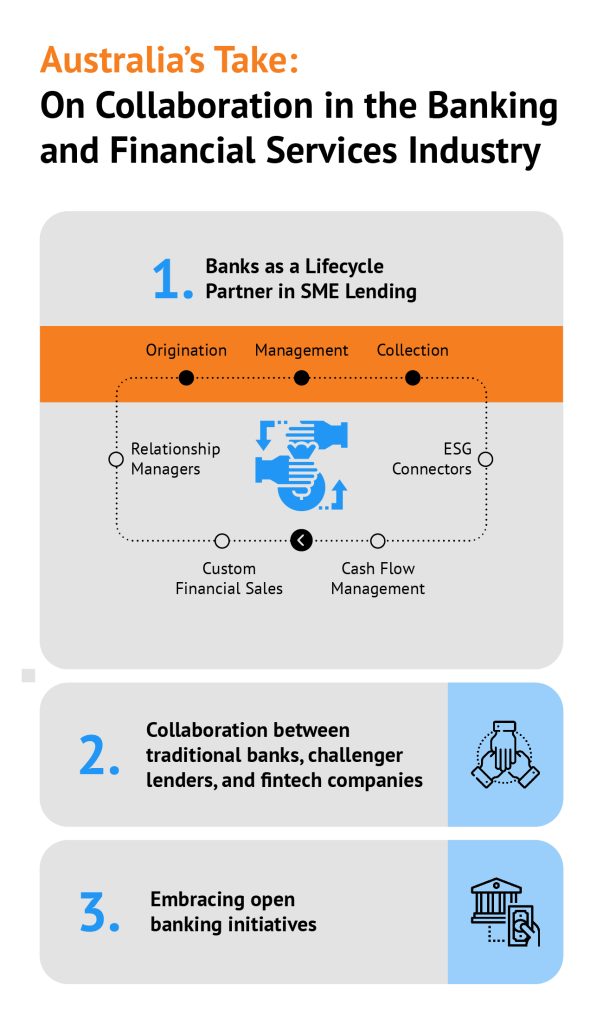

1. Financial institutions as Lifecycle Partners in SME Lending

There is an increasing need to evolve beyond traditional lending products and become comprehensive lifecycle partners for SMEs. Judo Bank & NAB are shining examples of banks that are positioned as a comprehensive lifecycle moment of truth partner for a business instead of just a lender. Banks have the opportunity to fulfil that role by bundling offerings like dedicated relationship managers, customised financial solutions, ESG consultancy services, cash flow management, and more. By offering holistic solutions, you can enhance your value proposition and deepen your relationships with SME clients. This also enables the materially addressable market of “BO-HO” (Business Owner- Homeowner cross sell) segment to become a possibility of revenue expansion for the major banks.

2. Collaboration is key to accelerating SME lending

Collaboration between traditional banks, challenger lenders, and fintech companies can also unlock new opportunities. By partnering with fintechs and utilising their expertise, traditional banks can accelerate their digital transformation initiatives and bring innovative products and services to the market.

Prospa, Moula and Capify have provided over $3 billion in funding to SMEs. These alternative lenders are leveraging technology and data to offer faster loan approvals and a better customer experience. In response, banks have started partnering with fintechs, such as Westpac investing in Prospa. Banks can also learn from these new players to improve their own digital offerings. With specialised fintech partners readily streamlining and accelerating lending operations, you need to collaborate to truly move past your competition.

3. Embracing open banking initiatives to grow SME lending portfolios

Enabled by open APIs, open banking has the potential to revolutionise the SME lending sector by enhancing access to finance, simplifying the process of obtaining funding, opening up opportunities for cross-border lending, and accelerating loan processing times. This will also need consumer confidence in the cybersecurity & resilience practices of lenders for current ‘opt-in’ paradigms to become more widely adopted.

By enabling third-party validation / verification platforms to access approved and ‘opted-in’ financial data from banks and other institutions, Open Banking can speed up the loan application process by providing accurate and up-to-date borrower information. This data includes bank account details, credit history, and transactions, allowing lenders to make more informed lending decisions. Furthermore, Open Banking drives down costs associated with cross-border lending by eliminating fees for currency exchange, international transfers, and legal documentation, providing SMEs with more options for cross-border lending. By embracing open banking initiatives, banks can improve their SME lending operations, provide better customer experiences, and drive growth in their lending portfolios.

With NAB’s Quickbiz loans now offering small businesses up to $250k within 20 minutes, and CommBank’s Stream Working Capital launching as a fully digitised working capital solution; agility, speed, and modularity have become the key pillars to SME Lending growth.

A platform that can build for faster, automated, and cost-effective lending is the catalyst lenders need to accelerate growth with SME borrowers. A lending platform like Pennant can help you bring agility, speed, and modular lending journeys across the SME lending lifecycle. With a modular lending platform, you can easily embrace open banking by collaborating with fintech partners, accessing cloud data securely, and automating operations.

Banks also have an opportunity to accelerate SME lending by developing deep expertise and tailored solutions for key industry verticals. Judo Bank has built a specialist agribusiness banking team to serve the needs of farmers and agribusinesses. By gaining a deep understanding of the agricultural industry and the challenges farmers face, Judo Bank has been able to provide flexible financing solutions tailored to farmers’ needs and cash flow cycles.

As the SME lending landscape evolves, banks are already working on overcoming existing challenges and providing SMEs with the financial solutions they need to thrive and contribute to the Australian economy. The adoption of a lego-block based platform approach will be the differentiator in navigating the challenges of SME lending and building a robust foundation for the future.

Don’t miss the opportunity to shape the future of your bank and drive sustainable growth for your organisation. Schedule a call with our experts to explore transformative strategies for your business to accelerate growth for SME loans.

Recent Blogs