Over the months the articles that I have come across start with a leading sentence: “Transformation is here to stay.” And the banking industry has not been immune like any other industry, though some have been slower to transform and adapt than others. But all have been in that same orbit of change. And the race for transformation is not just about going digital but modernise.

Today’s consumers have been quick like a flash to adapt and adopt digital technologies in their everyday lives, which means businesses across every industry need to keep pace. The COVID-19 pandemic also became a factor to accelerate this trend. It became the new norm to work with more agility and flexibility as work and life grew increasingly remote and dispersed. Simply put; to keep business moving, companies must adopt modernisation nurturing from transformation and innovation.

Now what this entire story leads to for consumer lending? It’s time to simplify the loan servicing process and provide the experiences customers now expect. Let’s explore how all types of lenders, from auto to home to student to personal lending, can make the shift to modernised consumer lending.

What Do You Mean by Consumer Lending?

We all are Humans, and we all have our specific needs and wants from life. To meet those needs or wants, we sometimes need a financial push. And that push is given by Consumer loans.

For example, I am an employee, and I need finance to buy a new air-conditioner or a new refrigerator or to go on a vacation to Maldives. To turn this need into a reality, I would need a consumer loan provided by my bank or another financial institution.

Long tale short. Consumer lending deals with the financing of personal loans. It refers to loan services primarily meant for the personal needs of individuals. These loans are long-term or short-term in nature and unlike business lending it does not require collateral.

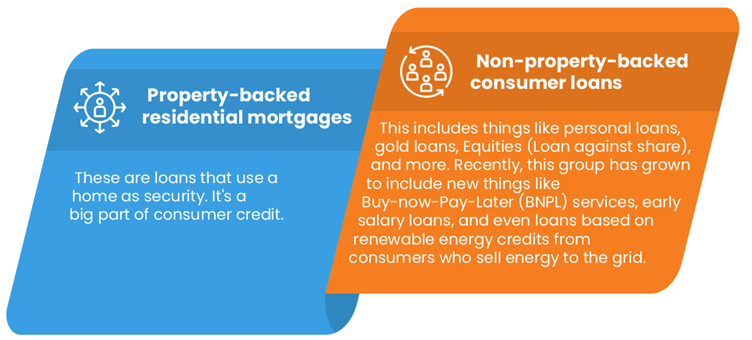

The Categorisation of Consumer Loans into 2 Groups:

The shift: From going in person to using digital tools

From time iception, getting a consumer loan meant visiting a bank branch and talking to a loan officer.

You’d discuss your needs and gather the necessary financial documents. The process was mostly done manually on papers and was time intensive. In recent years, there is a shift, more people have started using digital first options for their loans. Here are the benefits of moving to modern consumer lending:

How banks and financial institutions should prepare?

We are moving from a state of low demand and low supply to a situation with growing demand while the supply side struggles to keep up.

Today banks and financial institutions of all sizes face challenges from changing consumer behavior and the need to offer the right products and experiences.

To meet this new demand and reach new customers, banks must leverage data and technology in their loan processes.

Here’s what they should do:

The Solution: Platform-Agnostic, Low-Code / No-Code / Pro-Code Lending Models

In today’s fast-paced digital lending environment, banks and financial institutions must be equipped with the agility to quickly adapt to shifting customer expectations. Whether it’s launching new loan products, expanding into new channels, or delivering personalised experiences, staying responsive requires a technology foundation that is as flexible as the market itself.

A platform-agnostic, low-code/no-code/pro-code approach offers the ideal lending model to meet these challenges. By decoupling the technology from underlying infrastructure and enabling rapid development, banks can build, test, and deploy solutions that respond to customer needs in real time without being locked into rigid systems.

Such platforms empower banks to transform how they manage data, enabling seamless data exchange, faster analytics, and actionable insights for customers and sales teams alike. With built-in AI, machine learning, and advanced analytics, enterprises can not only enhance operational efficiency but also offer enriched, omnichannel customer experiences while proactively managing fraud risks.

Leading banks and financial institutions are already leveraging comprehensive, modular platforms that support multiple development modes allowing teams to build simple workflows with no-code tools, design complex business logic using low-code interfaces, or extend functionalities with pro-code customisation where needed.

This approach helps reduce costs, streamline operations, and improve engagement across touchpoints ultimately driving growth and customer satisfaction.

Looking ahead:

The consumer lending sector will continue to evolve as lenders adopt cloud, AI, data, and analytics for better outcomes. By combining AI-driven underwriting, a customer-first service model, and personalised cross-sell strategies, lenders can build quality portfolios, enhance customer experiences, and drive sustainable growth.

To know more, talk to an expert at Pennant Technologies.

Recent Blogs