Maximise your collection success by prioritising and sequencing various segments of delinquent customers, resulting in significantly higher recover rates.

Streamline the collection follow-up with delinquent customer through effective contact management via telecalling and auto dialers. With Pennant’s automated Debt Collection System, save valuable time and effort otherwise spent on manual research and review, allowing your team to focus on what matters most.

Streamline your debt recovery efforts with comprehensive legal workflows tailored to meet regional legal requirements. Utilise structured recovery processes and legal safeguards to effectively recover dues, ensuring your interests are protected.

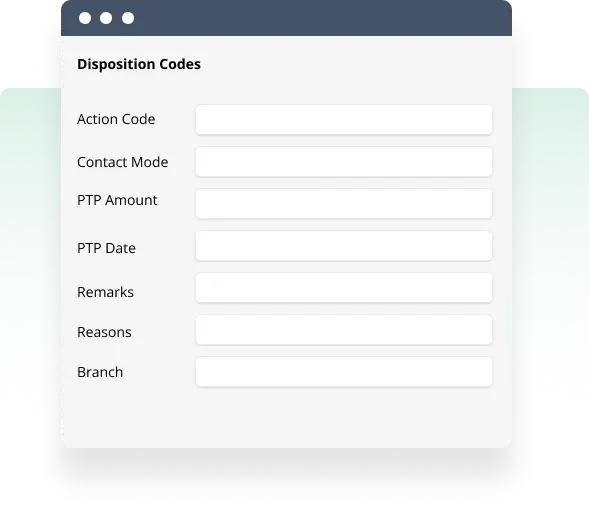

Efficiently manage and record diverse disposition codes such as customer call, promise-to-pay, refuse-to-pay, and customer deceased across multiple channels. The debt collection software ensures accurate tracking and streamlined communication, enhancing the overall collections process.

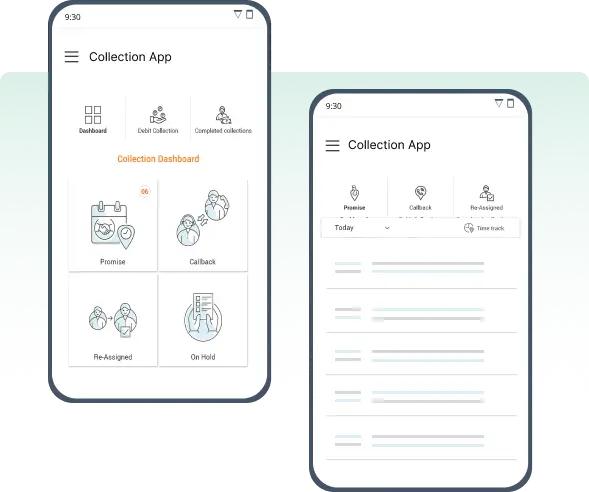

Transform your field collections with a mobile solution that enables flexible operations, including geo-tagging of customer locations. With the mobile-enabled debt collection software, empower field agents to manage the collection process, issue receipts on the field, and record field disposition codes.

Our debt collections software offers automated bucket management (DPD-based), customer segmentation, follow-up workflows, and custom strategies for each delinquency stage.

Yes, the platform allows dynamic assignment of cases based on collector type, region, product, and DPD stage, with performance tracking.

Absolutely. The module includes integration with mobile apps for field agents, along with digital nudges via SMS, WhatsApp, IVR, and payment links.

Yes. Agents can capture promises, reschedule callbacks, and track broken promises. Automated escalation and dashboards are built in.

The debt collections software supports multi-channel communication with event-based triggers, templates, scheduling, and regulatory-compliant contact history tracking.

Yes. The collection solution supports initiation, tracking, and closure of legal actions and repossession cases, including notice generation and expense tracking.

The debt collections management software module provides real-time dashboards on recovery, agent performance, PTP success, NPA flow, and legal action status, among others.

Yes. The module supports case allocation and communication with external agencies, with full auditability and data control.