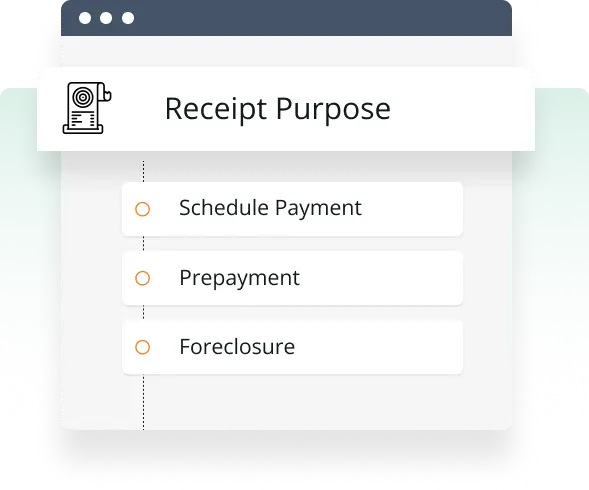

Repayments

Made Easy

Our loan management solution offers multiple flexible repayment options, simplifying loan servicing for your customers. This functionality ensures accurate tracking of loan repayments, which is crucial for effective cash flow management.

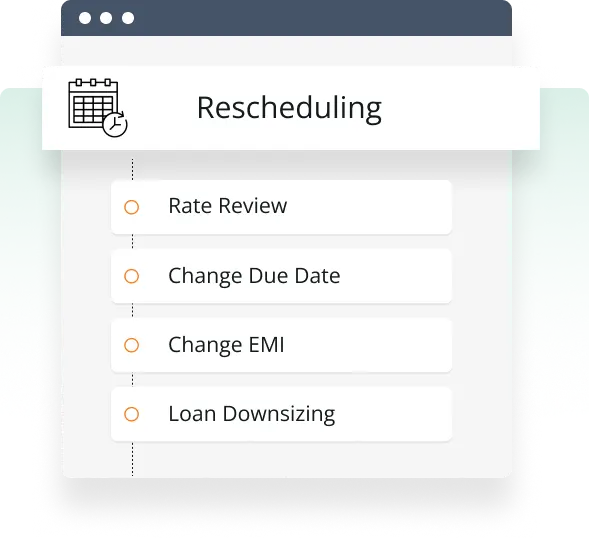

On-Demand

Rescheduling

Flexible rescheduling options enhance your customers’ loan servicing experience. The loan management solution regularises and supports various rescheduling features, allowing you to customise and structure repayment schedules based on their specific needs across consumer, mortgage and commercial loans.

Flexible Restructuring

A variety of restructuring options enhances your customer’s loan servicing. Tailor loan term adjustments, like extending payment periods, reducing interest rates, or modifying repayment schedules, to align with their evolving financial circumstances.

Highly Configurable Limits Management

Set appropriate limits in the loan management software based on borrower profiles and market conditions to effectively manage and mitigate credit risk. With customisable customer and organisation level limits, including currency options, you can prevent over-exposure to high-risk borrowers and sectors.

Event-Based

Accounting Engine

Replicate your chart of accounts and configure accounting templates for various transactions or events to ensure consistent application of accounting rules and standards. This enhances cash flow management by accurately recording loan disbursements, repayments, and interest accruals.

Asset Classification and NPA Management

Streamline the loan journey for customers experiencing delays or overdue payments, allowing stakeholders to track movements across the organisation and branches with NPA reports and visual dashboards. This facilitates efficient resource allocation by clearly distinguishing between high-performing and underperforming assets.

Powerful Multi-Server

EOD Function

Enjoy near 24/7 availability with innovative multi-server, multi-thread End-of-Day (EOD) activities that ensure minimal downtime during batch processing. This enables the reconciliation process, delivering reliable service while maintaining the integrity of your transaction records.